Look no further than Facebook! If you are a life insurance agent who wants to more effectively market your products and services, Facebook is a great option for you! Facebook Ads is definitely worth considering if you want to be effective in digital marketing.

The most effective way to advertise on Facebook is through Facebook Ads, which target new and existing customers equally well, unless a more targeted approach is needed. Ads on Facebook have a potential reach of nearly 2 billion people.

Facebook Ads Campaign Basics

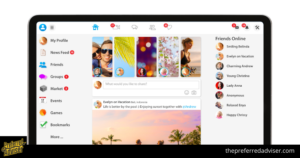

Facebook Ads allows you to reach a wider audience than just your current followers. The ads are tagged “sponsored” and appear in a timeline just like any other post.

Facebook Ads allows you to reach a wider audience than just your current followers. The ads are tagged “sponsored” and appear in a timeline just like any other post.

Your ad will be placed on the right side of the Facebook page when viewed on a desktop and in users’ News Feeds when viewed on a mobile device. Ad placements can be customized to achieve your marketing goals.

For example, if you want more video views, you can place your ad next to the News Feed, where it is more likely to be seen. If you want more clicks on your website, you can put your ad in the right-hand column, where it will be more visible.

There are some things you should keep in mind to get a return on investment from your Facebook ads manager.

1. Niche Down Your Targeting

Most people target as many appropriate people as possible when running an ad. This is a mistake that is commonly made in the insurance business.

Running separate campaigns for each target will allow you to get more accurate data on what works and what doesn’t.

You can create campaigns specifically targeting certain age groups. For example, if you want to target people in their 40s and 50s, create a campaign specifically for that age group. Next, create separate campaigns that are tailored to different demographics such as gender, location, interests, and behaviors.

Start with a small target audience and expand it once you know what works.

2. Ask Qualifying Questions

Make sure your lead forms have questions that will help you qualify leads. Having a lot of leads is important, but it’s also crucial that you don’t spend your time talking to people who aren’t interested.

Make sure your lead forms have questions that will help you qualify leads. Having a lot of leads is important, but it’s also crucial that you don’t spend your time talking to people who aren’t interested.

Here are some examples of questions you could ask to get someone thinking about life insurance: -Are you currently in the market for life insurance? -What is your budget for life insurance? -What are your thoughts on life insurance? -Do you think life insurance is something you need? -What are your concerns about life insurance?

This will help you identify people who are not actually interested in buying life insurance, and it will also give you an idea of what they are looking for so you can better tailor your sales pitch.

3. Tell Them Something

Another good practice for displaying ads is to show a fact or to provide helpful information. There are some things about the products that the customers may not know which could be helpful to them.

4. Split Test Everything

Split testing is a method of testing in which only one variable is changed at a time in order to gauge the impact of that particular change.

To find the best option, test one thing at a time and then choose the best option. After you test one thing, rinse it off and repeat the process until you have the best possible performance for your campaign.

5. Instant Gratification

You are more likely to get leads if you can offer your audience something valuable immediately.

What are the benefits of your product? How does your product compare to the competition? Don’t pay for leads that just want free information by settling for a generic eBook.

Steps to Creating Your Life Insurance Facebook Ads

1. The Objective

Facebook advertising offers customized solutions for various marketing objectives. Focus on delivering customized output that drives good ROI.

2. The Audience

It is important to develop a targeted market, which will help improve conversions. The more you understand your target audience and niche down to them, the more effective your insurance marketing campaigns will be.

3. The Message

Selling life insurance is not an easy task. You need a message that is so convincing that it will make your audience understand why life insurance is important.

4. Placement of the Advertising

Although Facebook recommends using its Automatic placement services, it is not the most efficient method to start with for your ads. Start by selecting Feeds. Most people use Facebook by logging into the app on their mobile phone or laptop. Once they are logged in, they can view their feed.

After you’ve placed your ads on Facebook, you can start to expand your placement and put your ads on Instagram, Messenger, and Audience Network.

5. The Budget

The cost of Facebook insurance ads varies depending on how well they target the audience and how well they perform. The average cost for a Facebook insurance ad is $100 to $500 per day.

The cost of Facebook insurance ads varies depending on how well they target the audience and how well they perform. The average cost for a Facebook insurance ad is $100 to $500 per day.

A good way to start is by allocating a budget you are comfortable with and gradually increasing it over time. Starting with $10 a day is just fine.

6. The Format of Your Facebook Insurance Ads

There are several Facebook ad formats available for life insurance agents. This allows you to create an insurance Facebook ad campaign that is specifically designed for your target audience.

The format options are:

- Carousel: This format is suitable for showcasing multiple products or services.

- Single image: Great for promoting a single product or service.

- Slideshow: A short video ad that uses still images.

- Video: A more extended video ad that tells a story.

You should test your ads in all available formats to see which one works best.

7. Use a Call-to-Action

Include a CTA in your ad that tells viewers what you want them to do, such as “Get a Quote” or “Learn More.”

Your call-to-action (CTA) should be clear and concise, and stand out from the rest of your advertisement. also, ensure your CTA is directly related to the rest of your advert. For example, if your ad is about life insurance, don’t have a call to action that says “Buy Now.”

8. Review Progress

After you have set up your Facebook coverage campaign, you can assess how well it is doing by looking at how many people have seen and interacted with your posts.

For example, if you are trying to compare different Facebook insurance advertisements, you can pick one and then ‘view chart’ to see specific metrics for that ad.

Easy Facebook Marketing Ideas for Insurance Agents

1. Ask Your Audience Questions

1. Ask Your Audience Questions

One way to get Facebook leads is to understand your audience. A poll can be a helpful way to understand what your client is looking for so that you can show how your products or services can fill that need.

For example, you may ask a multiple-choice question like:

What do you think about life insurance?

- It’s too expansive

- It’s too complicated

- Only old people need it

- I don’t want to talk about it

If the majority of your audience chooses one or two answers, You can then create content to address these concerned individuals and explain that the cost of life insurance is actually as little as a fraction of what most people think.

2. Post Consistently on Facebook

Make sure to frequently post interesting, relevant, educational, or funny content to your agency’s Facebook page to engage with your audience.

Make sure to frequently post interesting, relevant, educational, or funny content to your agency’s Facebook page to engage with your audience.

Being active online with the right kind of content is important for reaching people.

3. Focus on The Benefits, Not the Features

I get that you spent hours learning all the 33 features of a new product. You are very excited about them and you think it is very important to tell everyone about each one of them.

But you know what? They just don’t care. Who looks for insurance product features on Facebook? People think you just want to sell your products.

Your customers may only be interested in one or two features at some point in their lives. Explain how they can benefit from the features.

4. Sell Your Service on Top of the Benefits

If you know more about your product, you can provide a better solution. Use our service to save time and money.

5. Show Pictures of Your Client’s Claim Check

There is no more effective way to convince your potential customers of the benefits of insurance than by “showing them the money.” Giving your presentation an interesting story that illustrates how the proceeds of the event will help those in need will make it even more impactful.

6. Always Offer Value

It is important to understand the needs of your fans on Facebook. Your connection with your fans is important to maintain; if you lose touch with them, you’ll also lose their attention and any benefits that come from the relationship.

To keep people coming back to your page, provide them with content that they want on a regular basis.

7. Provide Insurance Discount/Saving Tips

Make sure to remind your clients annually about how important reviews can be for saving money. This way, they’ll know that you always have their best interests at heart. When you make positive changes in your life, such as reducing your risk factors, you may be eligible for discounts on your life insurance.

8. Provide Tips on Managing their Premium Payment

Instead of lowering the price, there are many ways to discuss premium insurance rates.

An insurance concept that can help your customer reduce, defer, or even skip paying their premium under different circumstances is ____________. Here are some keywords you may start with:

- Deductible

- Coinsurance

- No-Claim-Bonus (NBC)

- Waiver of premium

- Premium holiday

9. Share Videos of Funny Isurance Commercial

Who said insurance is boring? Insurers have been airing humorous commercials for over two decades now, since Geico gecko debuted in 1999.

There are plenty of funny commercials from different carriers that you can share on Facebook to get your audience’s attention and get them to share it.

10. Share Videos of Dogs and Cats

More than 50% of American homes have at least one pet. 1 in 3 dogs will get cancer over the course of their lifetime. And cancer treatment usually costs between $10,000 and $20,000.

Pet insurance is an effective way for your prospects to save on expensive vet bills. Be sure to include a call to action at the end of your post to get a free pet insurance quote.

11. Upload Interesting News Articles

You can use the Facebook content dashboard to find news stories that will help keep your clients informed about insurance. If you follow these tips, your Facebook posts will be more engaging and interesting.

12. Share Insurance Facts and Stats

You can help your audience understand the importance of insurance by sharing interesting facts and statistics about it. You may surprise them with some of the things you reveal, but ultimately this will help them know how insurance can benefit them during crucial periods in their lives.

Here are a few examples:

- Medical Bills Are the Leading Cause of Bankruptcy

- Four Out of Ten Americans Don’t Qualify for Life Insurance

- Your Marital Status Affect Your Premium for Auto Insurance

13. Give Useful Health Tips

Although you are in the business of selling life insurance, you would rather not pay out a claim if possible. This is because your agency cares about your client’s wellbeing.

What tips do you have for staying healthy and living a long life?

14. Offer Safety Tips for Driving

The internet can be a useful resource for finding out how to drive safely. Alternatively, taking an online defensive driving course can provide you with the skills and knowledge you need to stay safe on the roads. Examples may include:

- Safety Tips for Driving in at Night

- Safety Tips for Driving in the Water

- Safety Tips for Driving in the Snow

- Safety Tips Driving with Baby/Toddlers/Kids

If you want more people to like, share, and engage with your social media posts, try using some of these tips.

15. Give Major Traffic Updates

By posting about traffic gridlocks on your or your agency’s Facebook page, you can stay in touch with your clients and warn them about any major traffic problems.

Every time you save them from being stuck in gridlock, you become a hero. To stay informed about traffic conditions, sign up for traffic alerts.

16. Share Natural Disaster Alerts

Find something that is more unusual and offer safety advice if it happens. This sentence suggests that natural disasters would be a good place to start if you were looking for something.

17. Post Emergency Information During a Catastrophe

Concern for your fans’ wellbeing by posting info on emergencies and catastrophes is a good strategy. Social media posts can help you cultivate confidence in potential clients and win their trust, creating opportunities for your business.

0 comments